Comprehending Just How Credit History Repair Work Works to Boost Your Financial Health

The process includes identifying mistakes in credit history reports, challenging mistakes with credit scores bureaus, and bargaining with lenders to deal with outstanding debts. The inquiry stays: what particular approaches can individuals utilize to not only correct their credit score standing but likewise ensure enduring economic stability?

What Is Credit Score Repair Work?

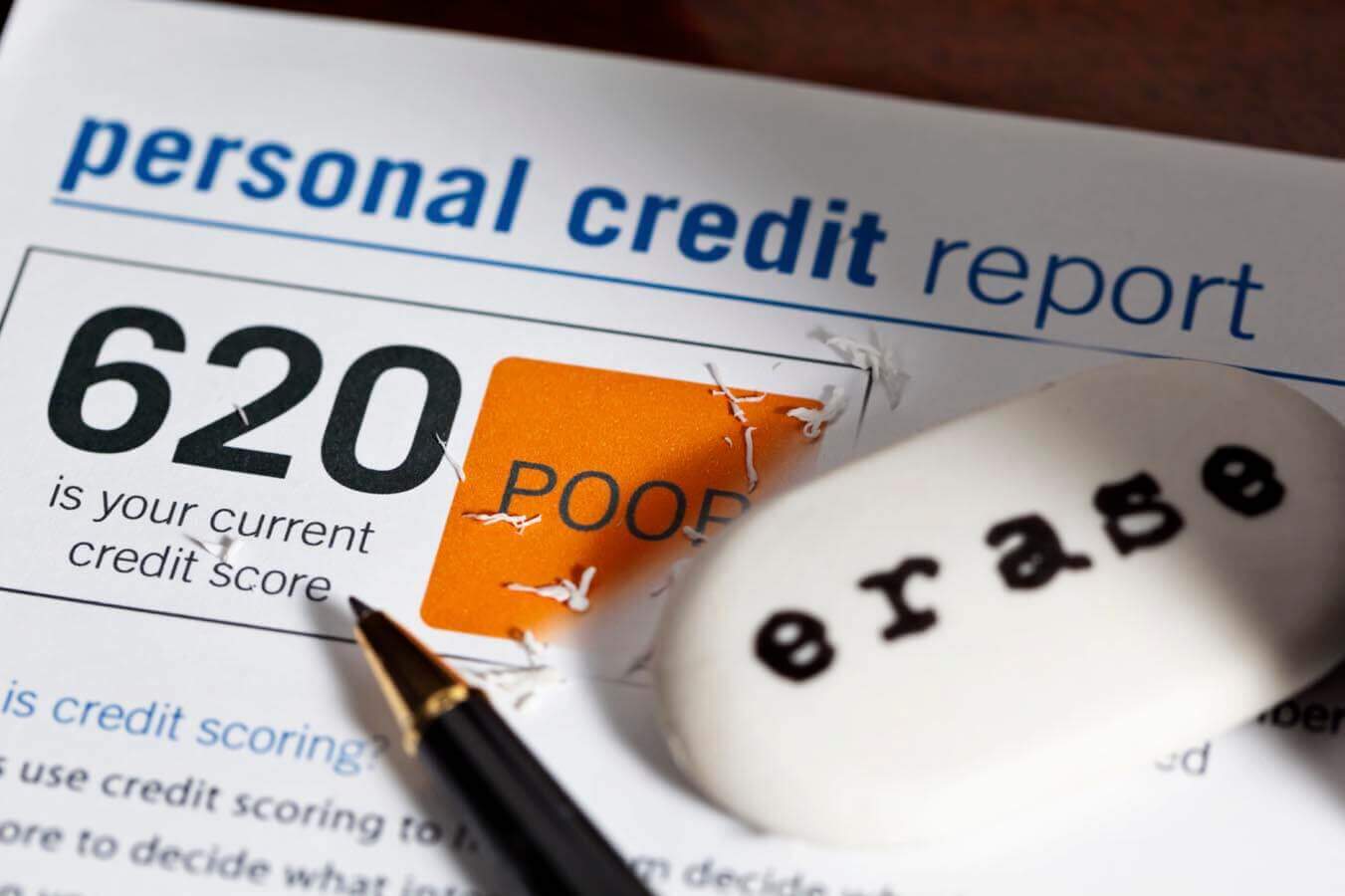

Debt repair work describes the process of enhancing a person's credit reliability by dealing with mistakes on their credit scores record, discussing debts, and taking on better monetary behaviors. This multifaceted strategy intends to enhance an individual's credit history, which is an essential consider protecting finances, bank card, and positive passion prices.

The credit rating repair procedure usually starts with a thorough review of the individual's credit scores record, enabling the identification of any type of inconsistencies or mistakes. The private or a credit history repair professional can initiate disagreements with credit rating bureaus to rectify these issues as soon as mistakes are pinpointed. In addition, bargaining with lenders to settle arrearages can even more improve one's economic standing.

Additionally, taking on prudent financial methods, such as timely expense payments, minimizing credit scores application, and preserving a varied credit report mix, contributes to a much healthier credit scores account. In general, credit repair service works as a vital strategy for individuals looking for to reclaim control over their financial wellness and protect better borrowing possibilities in the future - Credit Repair. By taking part in credit history repair, individuals can lead the way toward accomplishing their economic objectives and improving their overall top quality of life

Typical Credit History Record Errors

Errors on credit report records can significantly impact an individual's credit scores rating, making it essential to comprehend the typical types of mistakes that may develop. One widespread concern is wrong individual details, such as misspelled names, incorrect addresses, or incorrect Social Safety and security numbers. These errors can cause complication and misreporting of credit reliability.

One more usual mistake is the coverage of accounts that do not come from the person, usually as a result of identity burglary or clerical mistakes. This misallocation can unfairly lower a person's credit report rating. Additionally, late payments may be improperly videotaped, which can occur because of payment handling mistakes or wrong reporting by lending institutions.

Credit scores limitations and account equilibriums can also be misstated, leading to an altered sight of an individual's credit score usage proportion. Awareness of these typical mistakes is essential for reliable credit history monitoring and repair work, as resolving them promptly can assist people maintain a much healthier economic profile - Credit Repair.

Actions to Dispute Inaccuracies

Contesting errors on a credit report is a crucial procedure that can assist restore an individual's creditworthiness. The initial step includes acquiring a current copy of your credit score record from all 3 significant credit bureaus: Experian, TransUnion, and Equifax. Evaluation the report thoroughly to determine any type of errors, such as incorrect account info, balances, or settlement histories.

Next, launch the conflict process by speaking to the appropriate credit history bureau. When sending your conflict, plainly describe the errors, supply your proof, and include individual identification details.

After the dispute is filed, the credit score bureau will examine the insurance claim, normally within 30 days. Maintaining exact records throughout this procedure more info here is essential for effective resolution and tracking your credit score wellness.

Structure a Solid Credit Rating Profile

Constructing a solid credit report profile is important for securing desirable monetary opportunities. Consistently paying credit card costs, financings, and various other obligations on time is crucial, as repayment history dramatically affects credit ratings.

In addition, keeping low credit scores utilization ratios-- preferably under 30%-- is important. This suggests keeping charge card equilibriums well below their limitations. Expanding credit history types, such as a mix of rotating credit history (credit history cards) and installation fundings (vehicle or mortgage), can also improve credit report accounts.

On a regular basis keeping track of credit rating reports for errors is just as important. Individuals should evaluate their credit scores records at least each year to determine inconsistencies and contest any type of errors without delay. In addition, avoiding extreme credit score questions can prevent potential negative influence on debt ratings.

Lasting Advantages of Credit Fixing

In addition, a more powerful credit score profile can facilitate much better terms for insurance costs and even affect rental applications, making it much easier to secure real estate. The mental benefits must not be ignored; individuals that successfully repair their credit rating usually experience minimized stress and enhanced confidence in managing their funds.

Verdict

To conclude, credit score repair acts as a crucial device for enhancing monetary health and wellness. By recognizing and disputing inaccuracies in credit report records, individuals can correct mistakes that adversely influence their credit report ratings. Developing audio economic techniques better adds to constructing a durable credit rating profile. Ultimately, effective credit rating repair work not only helps with access to better car loans and lower rates of interest but additionally cultivates long-lasting monetary security, therefore advertising overall economic well-being.

The long-term benefits of credit scores repair service prolong much past simply enhanced debt ratings; they can significantly enhance an individual's overall financial health.